WALSH PURE SPREADER - Pure Hedge Division

WALSH PURE SPREADER

- Pure Hedge Division -

Rich Moran 9/17/2025

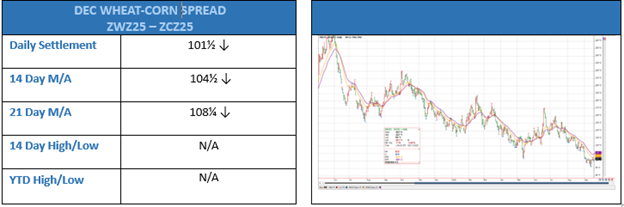

DEC Wheat-Corn Spread (ZWZ25-ZCZ25)

The DEC Wheat-Corn Spread (ZWZ25-ZCZ25) hit its 52-week high of 219¼ on 10/3/24. It has been trending down ever since and hit it 52-week low of 93½ last Friday, 9/12/25. This downward trend seems as though it may be running out of gas, but I would like to see it trade and settle above the 14-day and 21-day moving averages before making a trade on this. Today the spread settled 101½ with the 14-day settling 104½ and the 21-day settling 108¼.

If we can get the ZWZ25-ZCZ25 spread to trade and settle above these two moving averages, I think getting long this spread with a relatively short stop could be a good play. I believe this might offer us a nice risk to reward trade. I think we should risk about 15 cents or $750 Per Spread to make about 50 cents or $2,500 Per Spread, plus fees and commissions.

If you have any thoughts/questions on this article or any questions at all in regard to the commodities futures markets, please use this link - Sign Up Now

Following up on the still active past trade ideas:

* 9/12/25: ZLF26:H26:K26 (JAN-MAR-MAY Soybean Oil Butterfly)

Today’s settlement: -.20, Long at -.20

This is purely a Full Carry Comparison trade suggestion …. On Friday (9/12/25), I suggest trying to get long the ZLF26:H26:K26 butterfly on Monday at Friday’s settlement of -.20 or better (buying the JAN-MAR Soybean Oil spread .20 below where you sell the MAR-MAY Soybean Oil spread). Monday opened at -.20 and that was the high, so we are long at -20.

Risk 5 tics (-.25) or $30 Per Spread to make 20 tics (00.00) or $120. Per Spread, plus fees and commissions.

- 9/10/25: ZCZ25-ZCH26 (DEC-MAR Corn Spread)

Today’s settlement: -17¾, long at -17½

Today, ZCZ25-ZCH26 spread settled at -17½, the high of the day. This is just above both the 14-day and 21-day moving averages.

On Wednesday (9/10/25) I suggested that if the ZCZ25-ZCH26 opens at -17½ (Wednesday’s settlement) or higher, trying to get long the spread (buying Dec-Corn versus selling Mar’26-Corn) at -17½.

The spread opened at -17½ and traded lower, so we are long at -17½.

Risk 2 cents (-19½) or $100 Per Spread to make 6 cents (-11½) or $300 Per Spread, plus fees and commissions.

- 9/5/25: LEV25-HEV25 (OCT Live Cattle-OCT Lean Hogs)

Today’s settlement: 133.775, Short at 139.900

On Friday (9/5) I suggested trying to get short the LEV25-HEV25 Spread at 139.900 or better on Monday. We were able to sell the spread at 139.900 on Monday.

Risking 6.000 (145.900) or $2,400 Per Spread to make 18.000 (121.900) or $7,200 Per Spread, plus fees and commission. On 9/12/25 we moved our stop down to our entrance price of 139.900 for a scratch. I never like to turn a winner into a loser.

- 9/3/25: ZMZ25-ZMH26 (DEC-MAR Soybean-Meal Spread)

Today’s settlement: -9.7, Long at -10.2

On Wednesday (9/3/25) I suggested trying to get long the ZMZ25-ZMH26 Spread at Wednesday’s settlement of -10.2 or better when the market reopened for Thursday market. The opening was -10.2 and it traded -10.3, so we are long at -10.2.

We are risking 1.3 dollars (-11.5) or $130 Per Spread to make 5 dollars (-5.2) or $500 Per Spread, plus fees and commissions. On 9/12/25 we moved our stop down to our entrance price of -10.2 for a scratch. I never like to turn a winner into a loser.

- 8/27/25: ZSF26-ZSN26 (JAN-JULY’26 Soybean Spread)

If we can get back above and settle above the 14-day and 21-day moving averages, I think we should try buying the spread with a short stop below these moving averages.

Today, we settled -38½, slightly below the 14-day and the 21-day moving averages.

- 8/6/25: ZSX25-ZSF26 (NOV-JAN Soybean Spread)

Today’s Settlement: -19¼, long at -17½

The spread settled above the 14-day and the 21-day at -17¾ on 8/21/25. You should be long at -17½ from the open on 8/22/25.

Risking 3½ cents (-21) or $175 to make 9 ½ cents (-8) or $475

- 7/23/25: ZWZ25-ZWH26 (DEC’25-MAR’26 Wheat Spread))

Today’s Settlement: -18, Long at -18½

Risking 3½ cents (-22) or $175 Per Spread to make 10 cents (-8½) or $500 Per Spread, plus fees and commissions.

If you have any thoughts/questions on this article or any questions at all in regard to the commodities futures markets, please use this link - Sign Up Now

Rich Moran

Senior Commodities Broker

Direct: (312)985-0298

Cell: (773)502-5321

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.